PCE Deflator

The Personal Consumption Expenditures (PCE) deflator—the Federal Reserve’s preferred inflation gauge—was flat in March, pulling back from a gain of 0.4% in February and the slowest reading since November 2023. With that said, food prices jumped 0.5% in March, while energy costs declined by 2.7% for the month. Stripping out the more volatile food and energy categories, core PCE was also unchanged for the month, the lowest since April 2020.

On an annual basis, the PCE deflator rose 2.3% over the past year, down from 2.7% year-over-year in February and the slowest since October. In addition, core inflation moderated to 2.6% year-over-year in March, the best reading since June. Overall, core inflation has eased considerably from its pandemic-era peaks—7.1% for headline PCE in June 2022 and 5.5% for core PCE in September 2022—moving closer to the Fed’s 2% target. With that said, the prospect of higher tariffs could lift prices over the coming months.

As such, the Federal Reserve is expected to maintain a cautious stance at upcoming Federal Open Market Committee meetings, including the next one on May 6–7. The FOMC has signaled that it will take a wait-and-see approach on monetary policy as it assesses upcoming data. Interest rates are expected to remain elevated, even as the potential for cuts later this year remains on the table.

.jpg?lang=en-US)

Personal consumption expenditures rose 0.7% in March, building on a 0.5% gain in February. Notably, spending on foodservices and accommodations jumped 1.0%—rebounding from a 0.7% decline the month before and marking the strongest monthly increase since November 2023. On a year-over-year basis, total personal spending rose 5.6%, while foodservices and accommodations increased 3.8%. These figures point to continued resilience in consumer spending, even amid persistent economic uncertainty.

However, part of that growth reflects higher prices. Inflation-adjusted personal consumption rose 3.3% from a year earlier, while real spending on foodservices and accommodations was up a modest 0.9%. This suggests higher spending on dining and travel over the past year even when accounting for inflation, which is positive news.

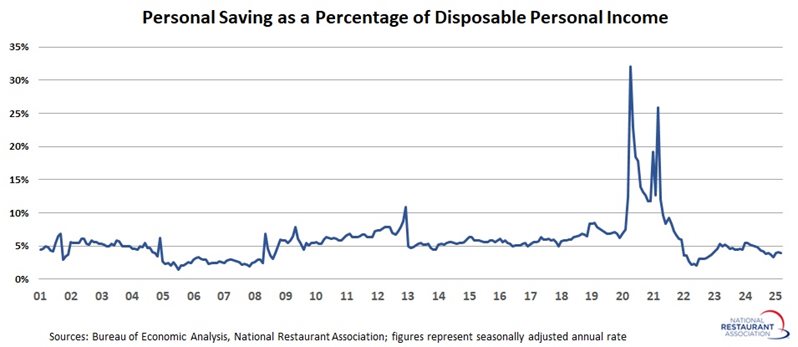

Despite these strong income gains, consumers appeared more cautious with their spending. The personal savings rate climbed from a cycle-low of 3.3% in December—the lowest since October 2022—to 3.9% in March. While this rebound suggests growing consumer restraint, it is important to note that the savings rate has been higher in recent years. For instance, the average savings rate hovered around 4.7% in 2023 and stands at 4.5% so far in 2024. As such, the consumer continues to dig into their savings to fuel at least some of their purchases.